Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

May 7, 2021—Markets were abuzz at 8:29 Friday morning ahead of the jobs report with official consensus forecasts of 1 million new jobs added in the month of April and “whisper expectations” (whatever those are) of 1.5 million. At 8:30 those expectations were thoroughly dashed upon the announcement of just 266,000 new jobs added and downward revisions to previous months. On top of that, the unemployment rate ticked up for the first time during this recovery.

Is this a harbinger of doom in the months ahead? Hardly. Although it was disappointing, we don’t believe the labor market is nearly as weak as the report suggests and we continue to expect strong economic and job growth through 2021. As for the impact on markets, the weak-but-positive number is, perhaps paradoxically, a positive, as it will allay fears of the Fed needing to tap the brakes in the near future.

Ignore the headline, see the trend

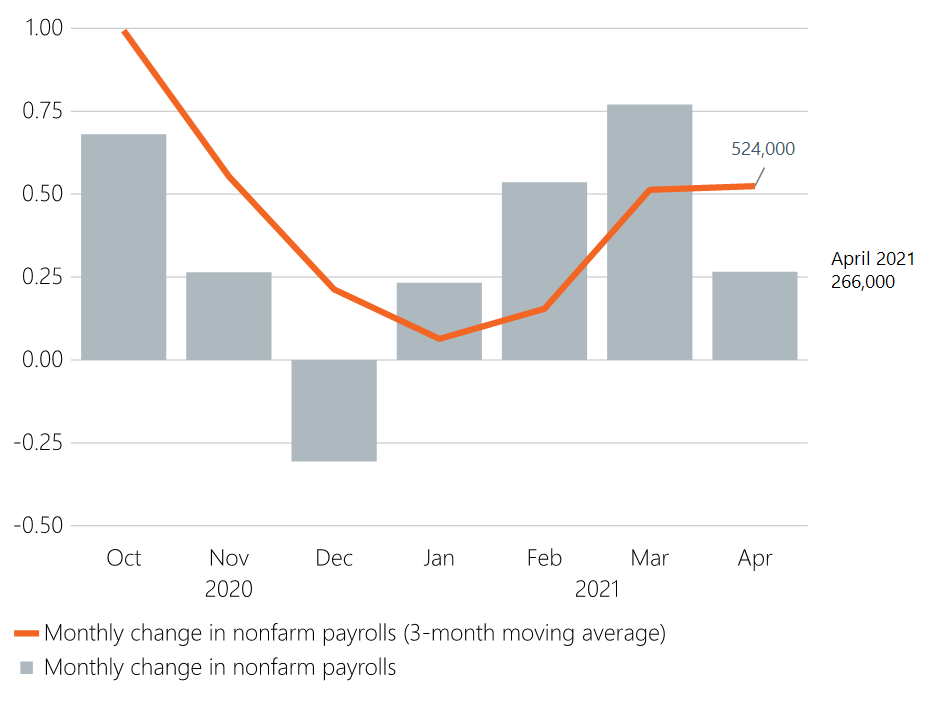

The first point is (unfortunately) quite wonky and boring, and is the recognition that economic data involve statistical noise and volatility. In plain English, it just means that job growth the in March was likely never as strong as the initial print of 916,000 (now revised down to a still strong 770,000), so there was some “give back” coming in April. It’s best to look at the underlying trend to smooth out some of this volatility, most easily done with a 3-month moving average as shown by the orange line in Figure 1. It shows a strong recovery from the incredibly weak winter as COVID ravaged the country and shut down businesses anew. We are now running at an average of just above 500,000 per month, a figure we expect to continue throughout 2021.

Figure 1: Monthly U.S. job growth and underlying trend (millions)

Data as of April 2021. Sources: Macrobond, Bureau of Labor Statistics, WTIA.

The government has a Herculean task of counting every single job added across the largest economy in the world. They do quite a good job of it, surveying firms that employ one-third of all relevant workers, which in statistics is a very large sample, but this statistical noise will continue.

Now hiring

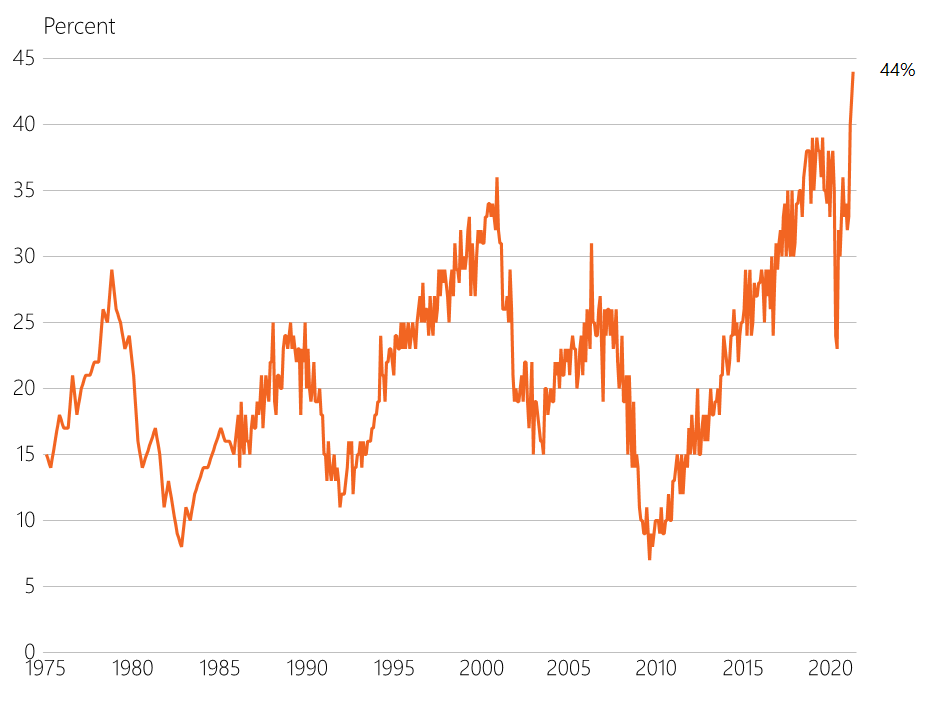

One of the main retardants for stronger job growth is the sheer unavailability of workers. There is a growing chorus of employers reporting inability to find qualified workers, or even to entice any workers to apply. Stories abound of fast-food restaurants paying people just to fill out applications and some are even offering hiring bonuses. The National Federal of Independent Business, a collection of very small establishments usually employing around 10 people, are reporting the most challenging hiring environment in their history, as shown in Figure 2.

The reason for the lack of workers is at least twofold: fear of Covid and generous unemployment benefits. A set of closely watched special questions in the jobs report showed 2.8 million people not in the labor force, not even looking for work in the past month, because of the pandemic. That could be for myriad reasons including fear of the virus, challenges with childcare, or a shift to virtual learning requiring a parent to stay at home. Encouragingly, the number of people citing COVID as a reason is down from nearly four million a month ago but is still a drag on the ability to hire.

We also know that unemployment benefits are generous, with recipients collecting the regular benefit, usually about 50% of previous pay, plus an extra $300 per week as part of the most recent stimulus package. For many workers that extra $300 translates to bringing home more on unemployment than what they were making at work. Estimates vary but it’s likely as high as 40% of recipients at the current level of benefit. We are not passing judgement on any workers nor making a political statement about the policy, but it’s easy to see that such generous benefits are an incentive to not return to work. If this program is preventing labor force participation, it will remain so until the program runs out on September 6, with some states such as South Carolina and Montana looking to end federal benefits even sooner.

Figure 2: Percent of small businesses unable to fill open job positions

Data as of April 2021. Source: Macrobond, National Federation of Independent Business.

Jumping back in

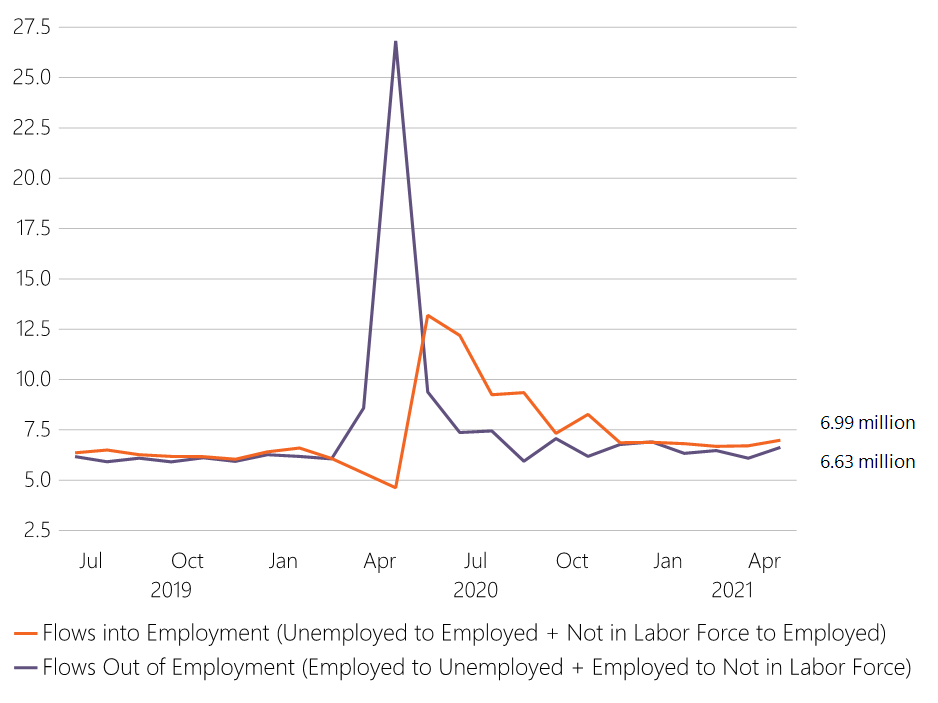

Last, despite the challenges in finding workers, we must recognize the trickle of workers back into the labor market. The unemployment rate ticked up from 6.0% to 6.1% last month, but only because 430,000 moved back into the labor force. About 330,000 of them found work while 100,000 did not. The simple math is that was enough to push the unemployment rate higher, but we should not overlook the fact that we’ve had net flows back into the labor market for all of 2021 following the challenging winter, as shown in Figure 3. We expect this net flow to continue with more vaccinations, as consumer spending moves higher, and especially if the special unemployment benefits are allowed to expire in the fall.

Figure 3: Movement in and out of the labor force (millions)

Data as of April 30, 2021. Source: Macrobond, Bureau of Labor Statistics.

Market impact

In a paradoxical sort of way, the weak jobs report is likely a boost to markets, at least in the short term because it extends the runway for the Fed’s market-friendly policy. Chair Powell has made it clear they will not even consider rate hikes until three hurdles are cleared, and one of them is the full recovery of the labor market. With so much strong economic data (until this jobs report) there was mounting anxiety the Fed may need to hike rates and reduce their asset buying program earlier than expected, which would likely be a detriment to equities. This jobs report should push those fears off for now. Equity markets responded quite positively on Friday.

Core narrative

We are optimistic for U.S. economic and job growth in the months ahead despite the weaker-than-expected jobs report for April. We expect jobs to be added at roughly a 500,000 per month rate this year, enough to support the recovery and keep the Fed at bay. We could see U.S. GDP growth as high as 9% in 2021. This would represent a meaningful upside surprise to consensus estimates. Though the equity market is certainly already baking in quite a bit of shared optimism, there is still room for revenue growth and operating leverage to carry equities higher over the next 12 months, and we hold an overweight position to equities versus our strategic benchmark. The ascension in interest rates looks to be taking a breather, but we expect rates too to move higher toward 2.00–2.25% for the 10-year Treasury. This backdrop has historically been conducive to value equities, and in March, we shifted portfolios to be better positioned for this outlook. This year the market has shown its refusal to move in a single direction for too long, so diversification and a focus on the medium term remain critical.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Third party trademarks and brands are the property of their respective owners. Any reference to company names mentioned in the podcast should not be constructed as investment advice or investment recommendations of those companies.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today