Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

March 26, 2021—We are currently overweight emerging markets equities—including Chinese equities. Four pillars support our position. First is our view that the vaccines have prompted a cyclical rally that is, in general, constructive for global equities. Second, we believe emerging markets will see faster economic growth than developed markets. Third, the Asia ex-Japan region, including China, has so far successfully managed the COVID-19 crisis, in our opinion. Fourth are our constructive views regarding Taiwanese and Korean semi-conductor and technology hardware stocks as well as Chinese internet platform stocks amid anti-trust concerns.

Chinese internet platform stocks—Alibaba, Tencent, and others—have been pioneers with respect to e-commerce, on-line gaming, internet chat, social media, e-payments, and other fintech[1] for the country. Alibaba and Tencent, in particular, have become behemoths, growing both organically and through acquisitions and partnerships.

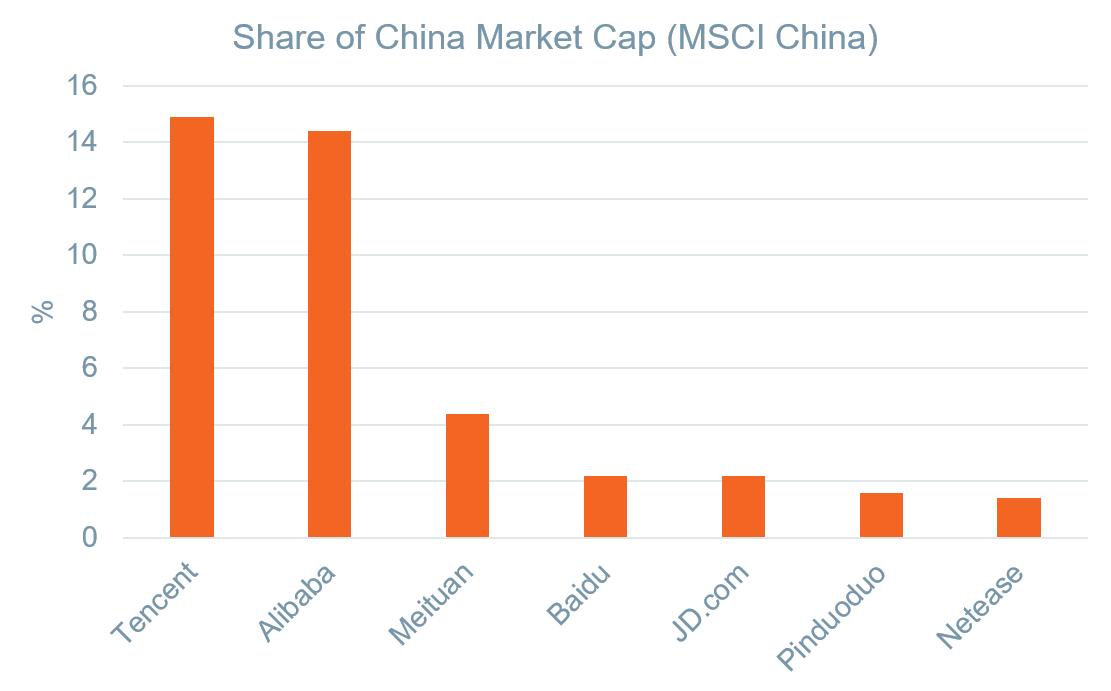

In recent months, the Chinese authorities have been taking actions to rein in the operations of many internet platforms. These measures have injected considerable regulatory uncertainty into these stocks’ equity valuations. Given that these stocks comprise a large portion of the country’s market capitalization, Chinese equities have underperformed broader global equities year-to-date. This Wilmington Wire explains how internet platform stocks grew to become so prominent, describes Beijing’s recent actions, and motivations, and provides our outlook for these stocks.

How did these firms become so prominent?

Pony Ma and Jack Ma (unrelated) founded Tencent and Alibaba, in 1998 and 1999, respectively, to serve a growing and increasingly mobile middle class. Tencent became market leader in on-line gaming, while Alibaba dominated e-commerce, becoming China’s Amazon. Both firms enjoyed first-mover advantage. They also benefited from Beijing’s willingness to deny U.S. internet platforms access to the local market.

Both firms introduced internet communications: Tencent developed instant messaging services QQ and WeChat, while Alibaba took a large stake in Twitter-like Weibo. Tencent was able to leverage WeChat into a social media platform to host video, sports, and other media. The two firms next entered the e-payments business, rolling out e-wallet applications WeChat Pay and AliPay. Widespread adoption of these e-wallets has sharply reduced the use of cash in Chinese society. Moreover, Alibaba and Tencent have leveraged their e-payments enabling them to offer micro-lending, insurance, and asset management. While Alibaba pulled its fintech business under an affiliate called Ant Financial, which it hoped to bring to IPO, Tencent offered fintech through multiple separate channels linked to WeChat Pay. Finally, Alibaba itself added media holdings, particularly, Hong Kong’s venerable South China Morning Post.

Alibaba and Tencent are invested in similar business lines and each maintains a hub-and-spoke approach toward acquisitions and partnerships with smaller firms. However, there is a critical difference in how the two firms have approached corporate expansion. Tencent has been acquiring small non-controlling stakes in new ventures, striking partnership and advisory agreements. By contrast, Alibaba’s approach has been to leverage its market power to attain majority stakes and secure management control.

There are also differences in public persona. Alibaba’s Jack Ma became a prominent personality, with a propensity for speaking freely in domestic and international fora, much to the annoyance of Chinese officials. Meanwhile, Tencent’s founder Pony Ma and his chief executives have maintained low public profiles, perhaps minding the Japanese proverb that “the nail that sticks out will get hammered.”

Fintech: What actions have the authorities taken—and why?

Last year, the authorities signaled their intention to bring fintech operations under greater financial services regulation hoping to slow the expansion of unofficial credit channels, which had become a threat to the country’s financial stability a few years earlier. They also sought to preclude asset bubbles, which China had previously experienced in property and stocks. Finally, they sought to maintain the clout of state-controlled banks, which have always played an essential role in funding Beijing’s five-year plan priorities as well as in the implementation of monetary policy.

While the authorities mulled the extension of financial services regulation to fintech, Jack Ma pursued plans for an IPO for Ant Financial, the Alibaba affiliate that operates AliPay and other fintech operations. This IPO would have made history: the largest IPO ever, executed entirely in Shanghai and Hong Kong. The authorities did not initially intervene in the IPO plans. However, Jack Ma gave a speech in which he criticized the government’s regulatory intentions. He noted that regulations appropriate for railroads should not apply to airlines, implying that banking regulations are not suitable for fintech. Dismayed by Jack Ma’s speech, the authorities immediately blocked the IPO. Jack Ma then disappeared for three months. When he re-emerged he adopted a lower and more conciliatory profile. Authorities have kept the Ant Financial IPO suspended while they figure out the best approach for regulating the platform. They also confirmed that they would apply the same regulation to Tencent’s fintech business.

It is also worth noting that the People’s Bank of China, the central bank, has begun an experimental rollout of its digital yuan. While this may seem an unrelated development, the digital yuan is essentially a competing e-wallet application. By offering the digital yuan free of charge, the central bank will be able to seize considerable market share payments from WeChat Pay and AliPay.

Media: How might divestment benefit the country?

Mid-March, the Chinese antitrust authorities ordered Alibaba to formulate plans to divest Weibo, the South China Morning Post, and other media-related assets. Two likely motivators behind the divestment order are: 1) divestment would prevent the possibility that Jack Ma, already a thorn in the side to authorities, could leverage his media assets into political influence, much as Silvio Berlusconi had accomplished in Italy and 2) divestment might provide Beijing the opportunity to shape news and editorial content in Hong Kong.

E-commerce: Can cessation limit competition?

Alibaba has taken various measures to limit the rising competitive threat from other e-commerce platforms. Of particular concern to Alibaba is Pinduoduo, which offers e-commerce through a virtual shopping experience. Currently, Pinduoduo’s customer base exceeds Alibaba’s, though revenues-per-customer is still far smaller. To date, Alibaba has declined to place its app on Tencent’s and other firms’ portals and has declined to place other firms’ apps on its portal. Alibaba also applies AI (artificial intelligence) techniques to consumer data acquired from its platforms to identify attractive business acquisition targets. Anti-trust authorities have responded by ordering a cessation to such practices. Moreover, authorities recently announced that founders of smaller firms would be able to hold special shares enabling the companies to continue to exercise management control, even after they are acquired by other firms. This aims to preclude Alibaba from engaging in hostile acquisitions.

What is our outlook for the internet platform stocks?

In the near term, we expect continued volatility in the share prices for Alibaba, Tencent, and other internet platforms while regulators find their footing. However, there is no reason to believe that anti-trust or other actions will negatively impact overall Chinese growth in demand for internet platform services, particularly given the underlying growth of the Chinese economy. Rather, these actions will impact how the internet-platform “sector” is organized.

We anticipate that Alibaba and Tencent will continue to grow revenues and earnings and deliver share price appreciation. Nevertheless, they will likely lose market share to other firms, creating a more competitive sector. We anticipate that this will spur innovation and prove constructive over the medium-to-long term for overall Chinese equity returns. However, it does mean that investors would no longer be able to rely entirely on Alibaba and Tencent to deliver high returns through their exercise of raw monopoly power. Rather, investors will have to sharpen their pencils and do the homework necessary to distinguish among a larger number of competing stocks.

Core narrative

We currently maintain a tactical overweight to emerging markets stocks. We continue to believe that the four pillars supporting this overweight remain intact. Vaccines have prompted a cyclical rally that is constructive for global equities. Emerging markets will see faster economic growth than developed markets. The Asia ex-Japan region, including China, has so far successfully managed the COVID-19 crisis. Finally, we are constructive regarding Taiwanese and Korean semi-conductor and technology hardware stocks as well as Chinese internet platform stocks, including Alibaba and Tencent and their up-and-coming competitors.

Data as of March 24, 2021. Source Bloomberg.

[1] Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Third party trademarks and brands are the property of their respective owners. Any reference to company names mentioned in the article should not be constructed as investment advice or investment recommendations of those companies.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today