Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

May 28, 2021

Heating up now, but set to cool in 2022

Prices are unmistakably on the rise and accelerating. Friday’s release of the Fed’s preferred gauge, the personal consumption expenditures price index (PCE), showed overall consumer prices rising 3.6% y/y, the highest since 2008. Part of the increase was expected because this most-watched y/y metric means comparing prices to those during pandemic-induced shutdowns in 2020 that sent everything into disarray. But it’s not all base effects; prices accelerated sharply on a single-month basis by 0.7%, the most since 2001. This could be a bit more alarming if it portends similar gains going forward.

We don’t expect inflation to keep climbing at the pace of this most recent report. In our view, the current jump in inflation reflects three largely temporary effects: the base effects discussed above, reopening effects, and supply shortages. The reopening effects are sensitive sectors (hotels, airlines, car rentals, sporting events) that have seen outsized gains as the economy returns closer to normal but still has much to gain following the sharp pandemic declines, shown using components of the other major inflation gauge, the CPI in Figure 1. We expect to see more monthly gains, possibly large ones, for items like these going forward, but not on a multi-year basis that would lead to the kind of inflation causing angst in markets.

Prices for used cars are quite different and are surging due to strong pandemic-driven demand and the well-documented supply chain issues facing auto manufacturers. We expect demand to relent somewhat in the second half of 2021, and for the supply chain problems to be resolved, even if only slowly.

Figure 1: Price indices for selected CPI components (February 2020 = 100)

Sources: Bureau of Labor Statistics, WTIA. Data as of April 30, 2021.

We think “transitory”

The main question for investors is whether the acceleration of inflation will be “persistent” and continue to run hot into 2022, or if it will be “transitory,” and slow down. If the former, the Fed would likely need to get more aggressive and tighten monetary policy more quickly than expected, possibly hiking rates by mid-2022. We believe it will be transitory, with inflation slowing in 2022, for three reasons:

Pandemic and stimulus are one-shot deals

Much of the inflation for goods and housing are one-off impacts. The massive spending done to fortify homes for the quarantine environment, such as new decks, patios, swimming pools, and exercise equipment, will abate as the economy reopens. Additionally, the last round of stimulus checks is out the door and will have diminishing impact as they are spent more slowly over the coming months.

The best cure for high prices is high prices

Suppliers are already responding to high prices by increasing production, which we expect to bring down prices. Construction materials are an excellent example, where producer prices were up 13% y/y through April, the highest since the 1970s. Firms are responding, and industrial production of those materials is up 16% y/y, an all-time high. There are supply chain issues, but we expect those to be managed over the course of 2021.

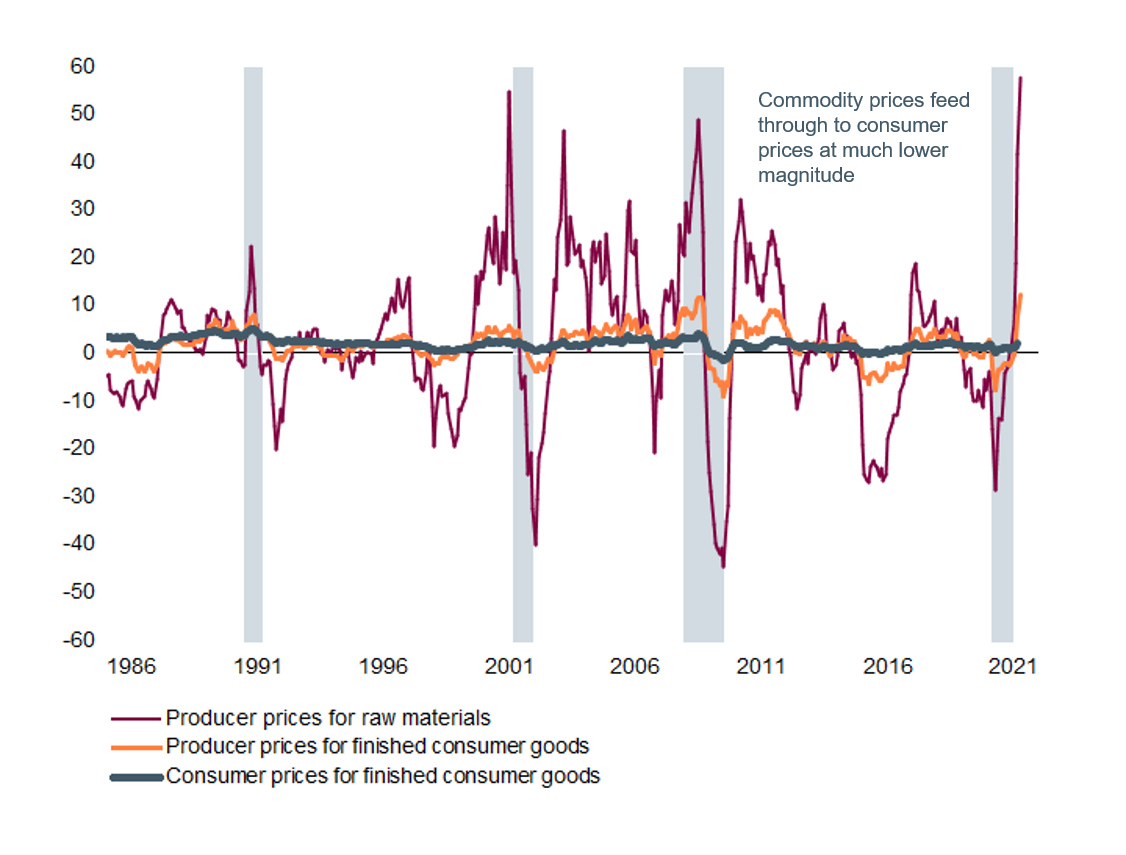

Wild swings in commodity and producer prices are nothing new and are much larger in magnitude than end prices for the consumer, as shown in Figure 2. Prices for raw materials soared 58% y/y through April (magenta) and those gains are feeding through to the intermediate prices for making consumer goods (orange) and are now beginning to pull up on the prices facing consumers. Our analysis shows a tight historical relationship, with about 15% of raw materials increases flowing to the intermediate goods, and about 40% of those prices going to consumers. If these magnitudes hold, the 58% would translate to 3.5% for consumers. The actual figure in April was quite close at 4.5%, the highest since 2011.

There are plenty of signs that price increases are meeting their limits, with producers or consumers balking at price tags. Lumber has been the proverbial “poster child” here, with prices on commodities exchanges rising from $360 per 110,000 board feet (about one rail car’s worth) to a peak of nearly $1,700 in early May before falling 25% to $1,300. Prices are still high relative to history, but with new construction slowing and lumber companies investing heavily to bring on new production later this year, we expect a sharp deceleration of commodity prices, which will then flow through the economy to consumers.

Productivity—making more with less

The final reason we expect inflation to cool in 2022 is increased productivity by firms, a topic we covered in detail in our annual Capital Markets Forecast. Firms in both the goods and services sectors have greatly increased their productivity over the course of the pandemic. Even though the economy is reopening, restaurants will not “forget” how to take an online order on their new apps, and hotels will continue to use their more efficient booking and check-in methods. Manufacturing output is just 1.6% below the pre-pandemic peak even though employment in the sector is down 8%. As the economy decelerates in 2022, we expect these more efficient firms to engage in competitive pricing to gain market share, putting a lid on future inflation.

Figure 2: Producer and consumer prices (% y/y)

Sources: Bureau of Labor Statistics, WTIA. Data as of April 30, 2021.

But the risk is to the upside

While our baseline expectation is for the inflation spike to be transitory, we do believe the risk lies to the upside and comes primarily from the labor market. Job openings are at all-time highs as businesses clamor to hire but report extreme difficulty in finding qualified workers or any applicants at all. People may be refraining for a slew of reasons, including COVID concerns, childcare problems stemming from virtual schooling, generous unemployment insurance benefits, and a noticeable increased pace of retirement.

A number of companies, including McDonalds, Amazon, Chipotle, Costco, Walmart, JP Morgan, Sheetz, and Bank of America, have announced wage increases in order to attract workers, which may ease the pain. The extra pandemic-era unemployment benefits officially expire on September 6, but some states have announced an earlier curtailment of benefits, starting in June and July, which could prompt some to return to work.

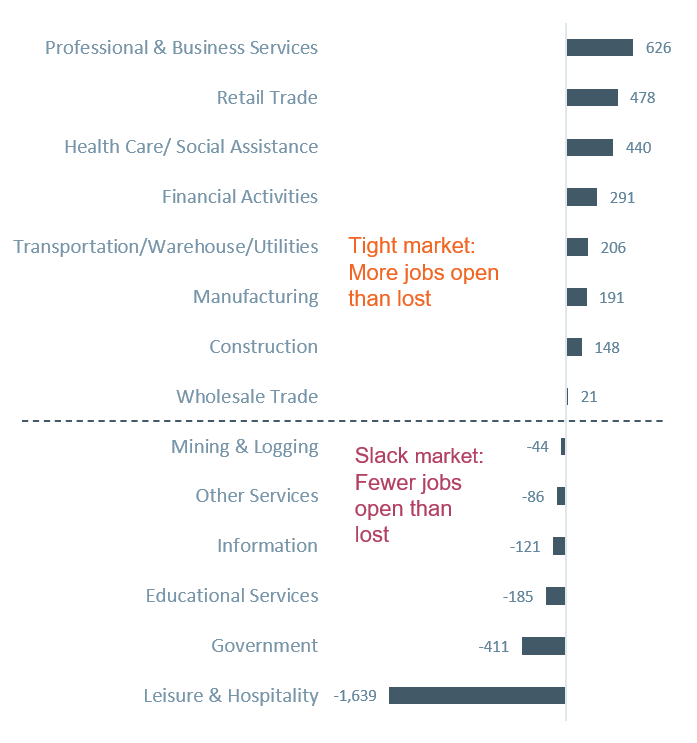

We believe one major, lingering issue will be a skills mismatch, stemming from a changed economy. Figure 3 shows that many sectors may simply be looking for workers that don’t yet exist. For example, there are 1.375 million job openings in the professional and business services sector, but the net job losses for the sector are just 748,000. So even if the 748,000 people previously employed in the sector returned to work today, there would still be 626,000 job openings to be filled. Figure 3 shows many sectors in the same boat, and they are the most likely candidates for continued wage pressure, in our view, which could then translate to higher inflation.

Figure 3: Current job openings minus net jobs lost since start of pandemic (thousands)

Sources: Bureau of Labor Statistics, WTIA.

What does it all mean for the Fed?

We don’t expect current inflation readings to force the Fed into hiking rates in 2021 or 2022, but we do expect an announcement to “taper” the current pace of asset purchases ($120 billion per month) later this year, possibly at the Jackson Hole research conference in August. To hike rates, the Fed has set forth three criteria that we’ve discussed before. They are:

For tapering of purchases, they need to see “substantial further progress” toward those three criteria. We believe they will deem enough progress has been made later this year to begin the tapering, but the labor market will not clear the hurdle to consider rate hikes.

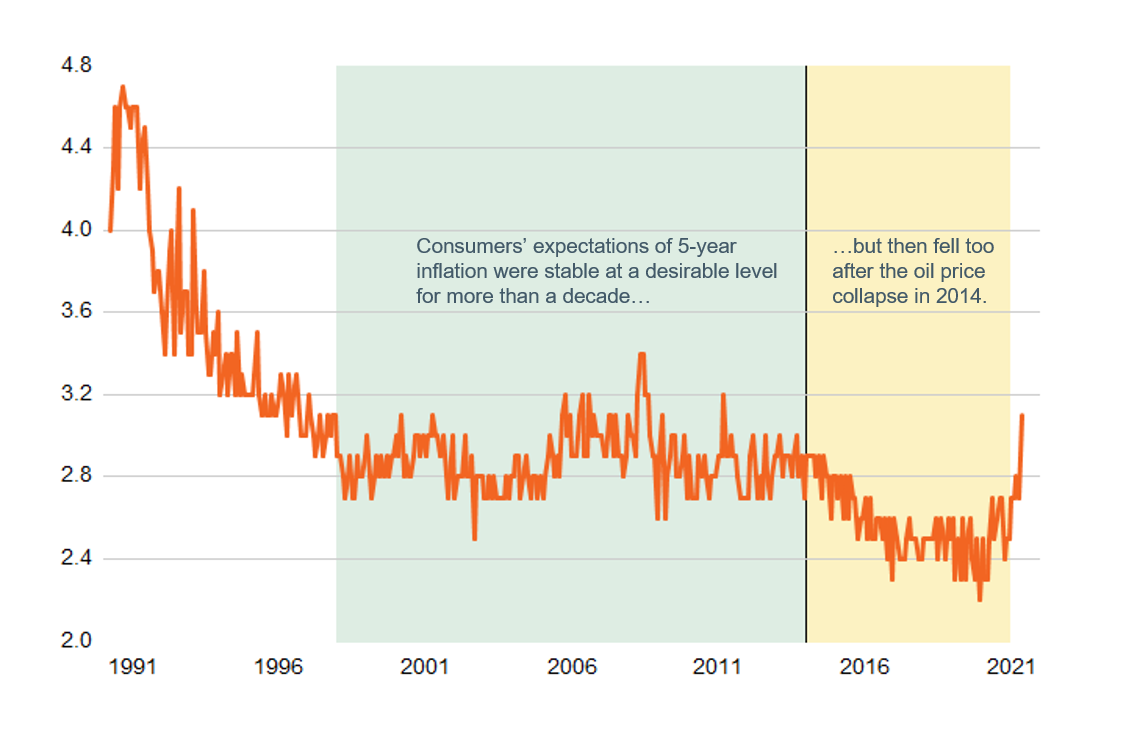

What will the Fed be watching to determine if inflation spike is more persistent, and to prompt them to take swifter action? The crucial question is whether consumers, firms, and markets expect longer-term inflation to remain under control after this expected burst in 2021. Expectations have moved sharply higher in 2021, and while the speed of the moves has been rapid, they are consistent with the average since the mid-1990s (Figure 4) and the Fed will likely view them as a relief that inflation expectations are arresting their post GFC downward drift. Pushing expectations higher was a key motivation for the shift toward their new monetary policy framework. The Fed may, however, become less comfortable if both of these longer-term measures move persistently higher on continued supply chain bottlenecks and a more persistent acceleration in wages.

Figure 4: Consumer expected five-year inflation (%)

Sources: University of Michigan Consumer Sentiment Survey, WTIA. Data as of April 30, 2021.

Core narrative

We remain constructive on the economy in 2021 and expect growth above 7.5%. Recent inflation reports show a heating up of prices leading to jitters in markets. While we do expect higher inflation over the course of 2021 than we’ve seen in previous years, we think the boost will be “transitory,” and that inflation will decelerate next year. This will enable the Fed to remain on the sidelines with rate hikes, though we expect them to slow the pace of asset purchases toward the end of 2021. We currently recommend overweight positions to equity asset classes and an underweight to fixed income. We also hold a small overweight to commodities. Within equities, we believe the broadening recovery, higher inflation and higher long-term rates will be supportive of cyclical and value stocks.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today