Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

August 9, 2021—Last week’s jobs report was strong for the second month in a row and immediately prompted questions about how it may affect the Federal Reserve’s dovish posture. With 1.9 million combined jobs added in June and July, gross domestic product (GDP) surpassing the pre-pandemic peak in 2Q 2021, and inflation at the highest in decades, it’s natural to think the Fed would normalize policy soon. Chair Powell and the other members of the Federal Open Market Committee (FOMC) at the Fed have delineated three criteria for changes to monetary policy, and a full recovery of the labor market is currently the furthest from being met, but if this burst of rehiring were to persist, the complexion could change soon.

While we’re optimistic about the economy and markets going forward, we do expect decelerations on all fronts in the second half of this year, and there is also the growing risk from the Delta variant of COVID-19. We still think rate hikes from the Fed are a long way off. We do expect the Fed to take its foot off the pedal later this year with asset purchases, likely in the fourth quarter.

Job growth heating up

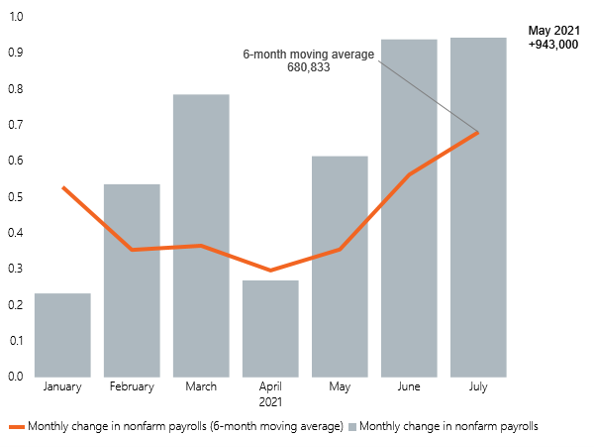

Job growth was robust in July for a second month, with employers adding a net 943,000 to their payrolls, higher than consensus forecasts of 870,000. Upward revisions added 119,000 in job gains to the prior two months. Monthly figures can be volatile, but this acceleration looks sturdy, with the underlying trend in job growth firming to 681,000 on a six-month basis as shown in Figure 1.

Figure 1: Monthly job growth (millions)

Sources: Bureau of Labor Statistics, WTIA. Data as of August 6, 2021.

The detailed breakdown by industry was encouraging. Restaurant, hotel, and casino jobs (leisure and hospitality) surged in the summer reopening, and those jobs accounted for the lion’s share of growth in July with 380,000 added. It wasn’t all restaurants though. Government jobs were boosted in part by unusual seasonal impacts for public schools, with more staff staying on hand than normally would. Construction jobs grew for the first time in three months. The retail sector was the only soft spot, with a modest loss after two months of gains.

Coming off the sidelines

Strong job growth was enabled by workers re-entering the labor force. Businesses’ challenges of finding people to fill open positions are well-known, and some of that pressure might be lightening up. Labor supply improved in July with an overall labor force gain of 260,000 and a tick up in the labor force participation rates for both prime-age workers (25–54yrs of age), and the overall labor force participation rate (+0.1pt each to 81.8% and 61.7%, respectively).

Although we don’t believe the generous unemployment insurance (U/I) benefits are the sole reason for the lack of workers, it has certainly been a factor. Roughly 50% of states took action in the past two months to curtail those generous benefits, which likely contributed to higher participation.

Also encouraging was the breakdown of newly engaged workers. In July, 525,000 people moved from “not in the labor force” to “employed,” suggesting that workers who have been coming off the sidelines of the labor market have been able to find jobs. The tight labor market is playing through to wage gains, which registered 4% year over year.

Will this continue?

While we’re encouraged by the strong jobs report, we think there are several reasons to be cautious that it can persist. First and foremost is the Delta variant of COVID-19, and the ongoing challenges of the disease. The nitty-gritty details of this “July” jobs report are that it truly covers jobs added from mid-June until July 17 (the cutoff date for the government statisticians), so it was likely unaffected by the new wave that has just started to ramp up at that point. We also note our high-frequency, daily tracker of employment is actually showing job losses so far for the August report.

More broadly, there will be a tug-of-war between competing forces for future job growth. Pushing it higher will be the expiration of generous U/I benefits for all states after Labor Day weekend, which will likely push many workers back into the market. However, not all labor supply issues are coming from U/I. There has also been a massive wave of retirement, and many labor force dropouts are connected to the virus, either to avoid infection or because they’re busy at home taking care of children or elderly. The return of the latter category depends wholly on the pandemic.

Lastly, aggregate labor demand looks high in terms of job openings, but we are confident that many employers have increased their productivity and efficiency to the point where they don’t need nearly as many workers as before the pandemic. GDP has already surpassed the pre-pandemic level by 1% but with roughly six million fewer workers. This will be countered to some degree by newly created jobs, but those jobs require new skills and will be harder to fill. Additionally, job postings may be plateauing; high-frequency data on job listings show some loss of momentum in new openings toward the end of July. This could be due to a combination of higher productivity at firms, as well as some easing of labor supply/demand imbalances as demand in surging sectors starts to cool and more workers return to the labor force as wages increase.

What does it all mean for the Fed and markets?

Markets can be fickle and might be susceptible to a “good news is bad news” paradigm where if the economy is improving too quickly, then markets may perform poorly. The rationale is an economy that roars back more quickly than expected could prompt the Fed to hike rates more quickly than expected and, in turn, do damage to equities. On balance, the labor market strength may move Fed actions earlier, but only marginally, and there are other factors to consider.

To support the economic recovery, the Fed has two major components of monetary policy:

As the economy improves, the Fed plans to “taper” their QE purchases down a bit each month until it comes down to zero, akin to taking one’s foot off the accelerator. Once that is complete the Fed can start pushing the brake pedal on the economy ever so slightly by raising the federal funds rate. It does not make too much sense to hit the brakes while you still have one foot on the accelerator, though there is an outside chance of slight overlap. The takeaway here: the start date and pace of tapering are paramount and are likely the hot topic of debate within the Fed right now.

To hike rates, the Fed has set forth three criteria that we’ve discussed before. In order to start the taper, the Fed wants to see “substantial progress” toward each of the three criteria. They are:

The inflation criteria have largely been met, at least for the moment, while the labor market still has a long way to go, with nearly six million jobs still to be recovered, and three million workers who have yet to return to the labor force. But with last week’s jobs report showing a marked acceleration, the prospect of tapering and rate hikes could move earlier in the calendar. We expect to hear more from Chair Powell on how the Fed is measuring progress in the labor market later this month at the Jackson Hole research conference.

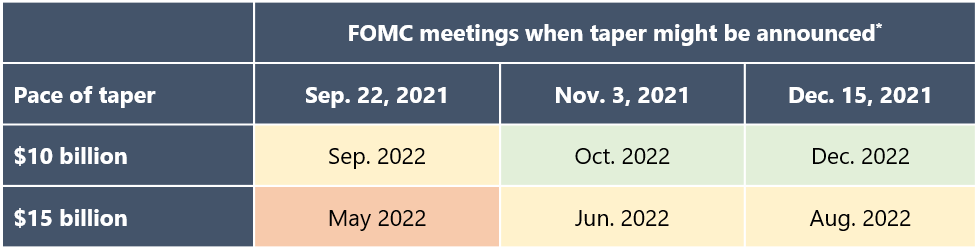

When a taper starts, we think the Fed is likely to taper by either $10 billion or $15 billion per month. The former would translate to a 12-month wait until any hikes but $15 billion per month shortens that to 8 months. The table below shows an array of scenarios for the tapering of QE over the remainder of the year, when such a taper would end, opening the door for rate hikes.

Table 1: Possible rate hike start dates in 2022 based on start date and pace of QE taper

*We assume a taper announced at the September 22 or December 15 meeting would begin implementation starting the following month of October or January. An announcement on November 3 would start within that month of November.

Clearly a faster taper of $15 billion per month announced at the Fed meeting of September 22, 2021, could bring about prospective rate hikes much earlier, in May 2022. We think that scenario would rattle equity markets but is highly unlikely. The three yellow shaded dates would be much earlier than we are anticipating, and earlier than is currently priced into financial markets. We think the two green shaded areas are more likely, a potential taper announcement at the upcoming November or December Fed meeting, opening the door for a potential first rate hike in October 2022 or December 2022, though they could pause before launching into rate hikes. All of this is highly contingent on the continued economic recovery.

Core narrative

We expect the economy to continue improving through the second half of this year. Continued growth should help drive continued demand for employees and the expiration of generous federal U/I benefits on September 7 will likely result in more workers returning to the workforce. However, the labor shortages are not entirely driven by U/I as there has been a large wave of retirement and the virus is keeping others at home. We expect job growth to decelerate. The recent strength does, on balance, bring forward the prospects for changes to monetary policy from the Federal Reserve. We expect a taper of QE to be announced late this year and for the taper to last until late 2022, after which the Fed would have the option to raise interest rates. We continue to recommend overweight positions to equities both domestic and international, and an underweight to fixed income.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today