Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

We are just past the halfway point of 2023, a natural time to pause and assess what has changed since the start of the year. In fact, the first seven months have certainly included twists and turns that few could have foreseen when the year began. In this late-summer check-in, we take stock of how our capital markets views have evolved, including what we predicted correctly, where we missed the mark, and what it means for client portfolios. In summary, our Capital Markets Forecast (CMF) is playing out largely as expected, and the U.S. economy has surprised to the upside. We maintain caution in our outlook for the remainder of the year.

Our 2023 CMF dug into the main issue facing consumers, policymakers, and investors: inflation. At the start of the year, our economics team predicted headline inflation—as measured by the year-over-year (y/y) change in the Consumer Price Index (CPI)—would continue its descent from the June 2022 peak, reaching “roughly 3% by mid-2023.” In fact, the headline CPI clocked in exactly at 3.0% in June 2023. More importantly (given the distortions that can be caused by base effects), the headline CPI has slowed from a three-month average annualized change of more than 10% to just 2.7% (Figure 1). This was aided by a 10% decline in commodity prices1 and slowing of goods inflation, as supply-chain pressures continued to abate, and consumption shifted from goods to services.

Figure 1: U.S. inflation is moderating

Consumer Price Index (CPI) inflation (% change)

Core (stripping out food and energy) and services inflation have both slowed as well, but, as predicted, at a slower pace. We are encouraged by the most recent data, which are showing convincing disinflation in services and shelter (the latter of which has been evident in more real-time housing and rental data but tend to show up in the CPI with a significant lag of 12 to 18 months). This improvement in the inflation picture comes despite a continued tight and overall robust labor market—of particular importance to services inflation given the prominent role that wages play in the cost structure of services-oriented businesses.

The Fed’s monetary policy has also transpired largely as predicted, with us anticipating the fed funds rate to reach “5.0% or slightly higher” in 2023; the Federal Open Market Committee (FOMC) raised its policy rate to a range of 5.25–5.50% at the July meeting. With inflation showing notable improvement toward the Fed’s target, it is likely that the FOMC exercises patience going forward, taking time to assess the impact of the tightening already implemented, before increasing rates even further. It is quite possible that July will prove to have been the last hike of the cycle. At this point, however, we are expecting one final “insurance” hike by the Fed, which likely will come in November.

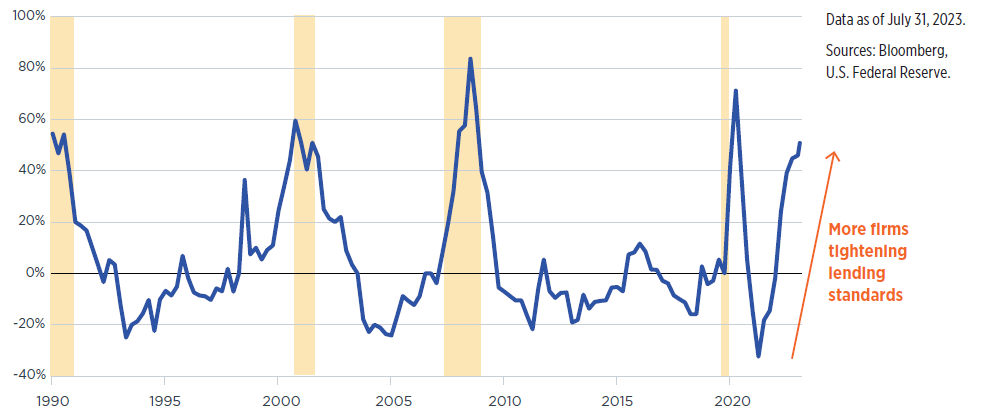

Financial conditions, by measures such as the Fed’s Senior Loan Officer Opinion Survey, have tightened significantly (Figure 2). The March bank failures were one artifact of the historic rapidity with which financial conditions tightened. Nonetheless, deposit flight and bank stress have now subsided. Other measures of financial conditions indicate that the long and variable lags of the Fed’s 525 basis points, or bps (5.25%), of tightening since March 2021 have yet to be fully manifest in the real economy—a risk discussed more below.

Figure 2: Lending conditions are tightening

Senior loan officer opinion survey—Net percent of lenders tightening standards for C&I loans to large/medium firms

Despite an expectation of near-term inflation falling from lofty levels, our Capital Markets Forecast delved into three structural themes expected to exert upward pressure on medium-term inflation. These three themes—a tight labor market, U.S.-China tensions, and the transition to a greener energy landscape—continue to challenge inflation’s return to the Fed’s 2% target on a sustainable basis.

Figure 3: Surge in prime-age labor force participation

U.S. labor force participation rate (25-54)

At the start of the year, we placed roughly 55%–60% odds on a recession occurring in 2023. As we sit today, the weight of economic signals point to continued U.S. economic resiliency. The labor market is expanding at a solid pace. Consumers, while having eroded a good chunk of their excess cash, are supported by positive real wages and continue to spend. Business sentiment has improved somewhat, and corporate capital expenditures remain positive. The U.S. economy grew at a real rate of 2.0% and 2.4% in the first and second quarters, respectively.

As a result, we have upgraded our economic outlook, reducing the odds of a recession to roughly 50/50 or even slightly in favor of a soft landing. Most encouraging is the evidence that disinflation can and has occurred without weakness in the labor market. In other words, a recession may not be a necessary condition for breaking the back of overall inflation, as many, including ourselves, feared. Still, it is too early to call the “all clear” and move definitively to a base case of a soft landing.

The Core Personal Consumption Expenditures Index (PCE), which is the Fed’s preferred measure of inflation and the one to which its 2% target best applies, is still averaging about 3.4% on a three month annualized basis and 4.1% y/y. That is not close enough to the Fed’s target to claim victory. While the Fed will certainly cease rate increases before core inflation hits its target (because of the lagged impact of policy tightening), the central bank is unlikely to cut rates until there is more evidence that inflation will not stage a resurgence. There is a risk that the last few miles to the Fed’s target could take longer, giving more time for the lagged effects of the Fed’s policy to weaken the overall economy to the point of sustained contraction.

While inflation has come down nicely and much of the economic data are holding up well, there are a few key risks worth monitoring. The first is the blaring signal coming from the yield curve, which has proven prescient in predicting prior recessions. The 10-year-minus-3-month portion of the yield curve has been inverted for eight months. Looking at the past six recessions, the time between inversion and recession has averaged 11 months.3 While it is certainly the case that markets have been wringing their hands about a recession for over a year now, we are just now entering the window when Fed policy historically bites its hardest. The lagged effects could very well be longer this time around, given the extraordinary amount of COVID-related fiscal stimulus pumped into the economy. This could mean higher rates for longer and a deeper recession.

Other, perhaps yellow flags, are coming from signs of fraying at the edge of the U.S. consumer. Personal consumption has indeed held up very well to date and, as noted above, is now supported by positive real wages. However, consumers’ excess savings is being depleted at a rapid rate (Figure 4). In addition, key credit metrics, including credit card delinquencies and auto loan rejections, are deteriorating at a pace that suggests they may overshoot prepandemic averages.

Figure 4: Consumers’ excess savings is coming back down to earth

Total household deposits through 1Q 2023

Since the start of the year, we have held a modest underweight to equities versus our long-term strategic asset allocation target, specifically within U.S. small-cap and international developed equities. Within equities, we have preferred growth over value and emphasized quality—a factor that encapsulates profitability, low leverage, and steady earnings growth. While the market melt-up has not benefited our tactical asset allocation positioning, the modest underweight has served as an insurance policy of sorts against a deterioration in the economy. Luckily, our full allocation to U.S. large cap (which has been the best-performing asset class this year, according to the S&P 500), along with our portfolio construction and patience in rebalancing accounts have all helped to offset the performance drag of our underweight to equities, allowing our average portfolio to perform in line with the blended benchmark. We have essentially paid insurance in the form of our equity underweight but still managed to keep up with the benchmark during a challenging time.

Figure 5: Current positioning

High-net-worth portfolios with private markets*

Fortunately for everyone, when it comes to the 60/40* stock/bond portfolio, our prediction that 2022 would end up being a painful anomaly, rather than the start of a pattern, has proven correct. With global equities returning 18.5% year to date and investment-grade municipal bonds up 2.8%, a 60/40 split between those asset classes is producing a solid 15% return through July. Our structural overweight to the U.S. versus non-U.S., something we discussed in our CMF, is also paying dividends over a naïve, market-cap-weighted benchmark.

We continue to look through short-term market noise and evaluate risk and return potential for asset classes over a 9- to 12-month horizon. That process leads us to the conclusion that patience is warranted on behalf of investors. We would caution against extrapolating the gains from the first half of the year into the second half. With recession odds still around a coin flip, we are hesitant to lean into risk. The market appears to be fully pricing a soft landing, and investors (particularly retail investors) have rushed back into equities.

Small-cap equities are quite exposed to elevated interest rates given their debt profile, and Europe appears to be in recession. China’s growth is languishing as well. Even in the case of a soft landing, expectations for earnings growth in the fourth quarter of 2023 and all of 2024 may be too optimistic. However, continued improvement in our economic outlook and further reduction of our recession odds would warrant consideration of adding to U.S. small cap, as well as potentially shifting from growth toward more cyclical value.

We believe the strong equity market performance warrants an evaluation of your portfolio’s current allocation versus the target set for your individual goals. In most cases, a diversified portfolio will have drifted away from target, leaving the account with an equity exposure meaningfully above the target exposure and potentially necessitating a trim of equities (and purchase of bonds) to bring that allocation back in line. We advise speaking to your advisor to see if this is applicable to your portfolio.

Please see important disclosures at the end of the article.

* S&P 500 and Bloomberg U.S. Aggregate

1 As measured by the Bloomberg Commodity Index between December 2022 and June 2023.

2 Oxford Economic.

3 Sources: Bloomberg, NBER, WTIA.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today