Navigating Market Volatility

Timely perspectives and actionable insights for navigating uncertainty.

90% of financial decisions are emotionally driven1

These emotions are often connected to individually unique experiences and biases, and memorable macroeconomic events.

1Kahneman, Daniel, and Amos Tversky. 1979. Prospect theory: An analysis of decision-making under risk. Econometrica 47, no. 2:171–85.

Capital Considerations: Managing the Emotions Behind our Decisions

Emerald GEM: Managing Emotions During Financial Uncertainty

Investor Psychology: How Emotions can Color our Decisions

Individual Investors

Inflation, the Fed, Midterms, and Portfolios: What's Ahead

Tony Roth, Luke Tilley, and Meghan Shue discuss potential impacts of the upcoming midterm elections and whether investors should become more cautious.

Earnings Recap: Glass Half Full?

Recession or No Recession? Depends on your Definition

Our Midyear Market and Economic Outlook

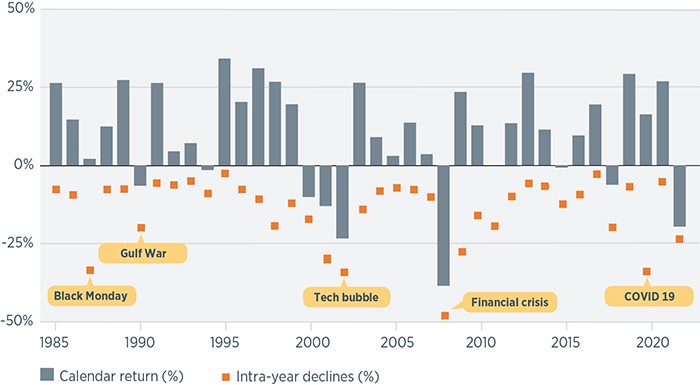

Managing the Ups and Downs

History shows that volatility is a normal, expected—and yet unsettling—part of investing. While you can’t keep it at bay, you can prepare your portfolio in advance to better react to unpredictable price movements when volatility is in play. And doing so will likely go a long way toward instilling confidence in your financial future.

Schedule a PARAGONTM (Portfolio Analysis, Risk Assessment, and Goals Optimization) review, where sophisticated planning software infused with our capital markets insights tests how a portfolio may fare under challenging “what if” scenarios.

Represents price return of the S&P 500 index. Data as of July 31, 2022. Sources: Macrobond, WTIA. Past performance cannot guarantee future results. Indices are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs, which will reduce returns.

Paragon® is a portfolio analysis, risk assessment, and goal optimization tool. The Paragon report uses hypothetical examples in conjunction with forecasts for inflation, economic growth, and asset class returns, volatility, and correlation and provides you with general financial planning information and to serve as on tool in helping you develop a strategy for pursuing your financial goals. It is not intended to provide specific legal, investment, accounting, tax or other professional advice. For specific advice on these aspects of your investments, you should consult your professional advisors.

Corporations & Institutions

Working Through Uncertainty: UK and EU Loan Market Trends

Coffee Tal(k): Navigating Increasingly Volatile Markets

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.